Workforce Housing in Seattle: Myth vs. Reality

For the better part of the past decade, both advocates and policymakers have been decrying Seattle’s perceived lack of housing affordable to people with incomes in the lower-middle range—so-called “workforce housing.” As a result, Seattle has implemented and is continuing to expand a program known as Incentive Zoning intended to create subsidized workforce housing through fees imposed on new development.

But there’s one rather important thing wrong with this picture:Â Available data show that there is no shortage of workforce housing in Seattle.

For reference, workforce housing is typically defined as housing that is affordable to households with incomes between 60 and 100% of area median income (AMI). In Seattle, 80% AMI corresponds to $49,440/year ($24/hour) for a single-person household. Assuming the standard that 30% of income is spent on housing, that translates to an “affordable” rent of up to $1342 per month.

For all the attention workforce housing gets, there’s surprisingly little up-to-date, hard data available on how much housing is out there priced at workforce affordability levels, compared to how many households there are that need it. King County analysis based on a 2009 survey of market-rate rentals found that a whopping 83% of units in Seattle were affordable to a household earning 80% of AMI. For 50% AMI, 37% of Seattle’s rental units were affordable. Across King County and the greater region, data reveal a similar pattern of excess housing supply at workforce income levels, along with a sharp increase in need the further income drops below workforce levels.

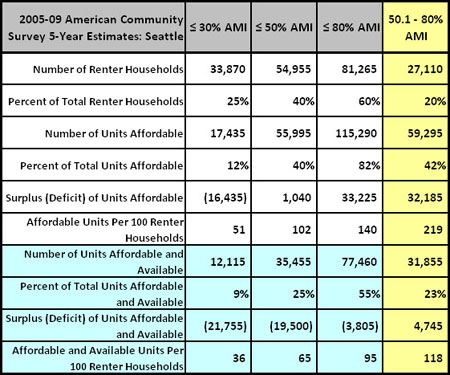

Based on the raw numbers there would seem to be plenty of existing workforce rental housing in Seattle, but one complicating factor is that some households may be renting housing that is cheaper than what they could afford according to the standard 30% formula. This “downrenting” has the effect of reducing the availability of housing that is affordable to lower incomes. The affordable housing advocacy group Housing Development Consortium has published some analysis by the Seattle Office of Housing on downrenting, and the results are summarized in the table below:

Looking specifically at households with incomes between 50 and 80% of AMI (yellow column)—which is the lower portion of the workforce range—there was a surplus of over 32,000 housing units with affordable rents. Put another way, for every 100 households in the 50-80% AMI range, there were 219 affordable rentals in Seattle.

After subtracting the number of units being rented by households earning more than 80% of AMI, there is still a surplus of 4,745 rental units affordable and available to 50-80% AMI households; for every 100 households in the 50-80% AMI range, there were 118 affordable and available rental units in Seattle. In other words, even when downrenting was accounted for, there was still no shortage of workforce housing.

Since 2009 housing costs have risen faster than incomes, so current data would likely show some reduction in affordability. And rents vary significantly between different neighborhoods. But even with those caveats, it’s hard to imagine how anyone could interpret the available data as proof of a dire need for programs to subsidize workforce housing in Seattle. Yet currently Seattle City Council’s affordable housing efforts are focused on an extensive examination of how to do exactly that using Incentive Zoning. Here’s how Council justifies it:

For example, a public school teacher’s starting salary of $42,000 suggests that he or she should not pay more than $1,050 per month (30%) for housing. Yet the average rent in Seattle for a 2 bedroom / 1 bath apartment is $1,466.

That’s right, we have a workforce housing crisis because a single person earning far less than the City’s average income can’t afford the City’s average rent for an apartment with an extra bedroom, never mind the half of the housing stock that rents below the average. And so apparently therefore we need to exact a toll on new development through Incentive Zoning so that someone making up to $49k can live in a subsidized apartment in a brand new downtown high rise. Seriously—if any of you reading this were in those shoes, would you feel entitled to that?

Meanwhile Council balks when it comes to solutions that would support meeting workforce housing needs through private development—no public expense necessary—such as microhousing, accessory dwelling units, meaningful upzones in lowrise zones, removing off-street parking requirements, and other strategies that could reduce the cost of producing housing.

In previous posts I have pointed out the numerous flaws in Incentive Zoning—how it defeats its own purpose by restricting supply and increasing the cost of housing production, how it’s based on an outdated paradigm that sees dense development as negative impact to be mitigated rather than a critical sustainability solution, and how its inherent limits preclude it from ever generating more than a drop in the bucket relative to the need.

Now we can add to that list of flaws the fact that Seattle’s Incentive Zoning Program was designed to subsidize workforce housing, even though the data indicate that the City already has enough. Available workforce housing may not be brand new housing. But even if new housing has rents higher than workforce affordability levels, it will still help preserve the availability of workforce housing by absorbing demand from a high-income renter who would otherwise be competing for, and driving up the prices of existing housing.

The City’s real housing need is at the deeper affordability levels, as the data clearly show an increasing deficit of affordable rentals as incomes drop below 50% AMI (see data table above). And yet another pitfall of Incentive Zoning is that even though it doesn’t address the real need, it creates the false impression that electeds are taking meaningful action to solve a housing problem. That is, Incentive Zoning is a politically expedient distraction.

To sum it up succinctly: Why are we applying an counterproductive tool to solve a problem we don’t have? We can and must find better solutions to address Seattle’s actual affordability needs.

>>>

P.S. For brand new info on the ineffectiveness of Seattle’s Incentive Zoning Program, check out this presentation by the City’s consultant, who found that 62% of of projects eligible for the incentive have opted not to develop the additional floor area. In other words, for most projects the Program is not an incentive because the fees are already too high.

>>>

This post originally appeared at Smart Growth Seattle.